VISLAND MORTGAGES

RATED NANAIMO'S

TOP MORTGAGE BROKER SINCE OPENING OUR DOORS

About VIsland Mortgages

Vancouver Island Mortgage is now in full swing with a highly skilled Team that has the capacity to grow the business to new heights.

Bill Fraser

Your Personal Mortgage Advisor

Bill has over 19 years working in the financial industry. Due to his extensive experience and knowledge he works efficiently with all lenders including: banks, credit unions, trust companies, financial institutions and mortgage investment companies. He is also able to offer his clients a variety of choices within his hundreds of products and services offered. These products include mortgages for purchasing new homes or investment properties, refinancing existing homes, debt consolidation, home equity line of credit, second homes, commercial as well as alternative or private lending. There is always an option when you deal with Bill Fraser!!

A 60 second introduction video to VISLAND Mortgages

VIsland Mortgages Receives Award

for

'3 Best Mortgage Brokers in Nanaimo, BC'

Services

Flexible Mortgages

Qualified Advice

No Cost to You

Advocacy

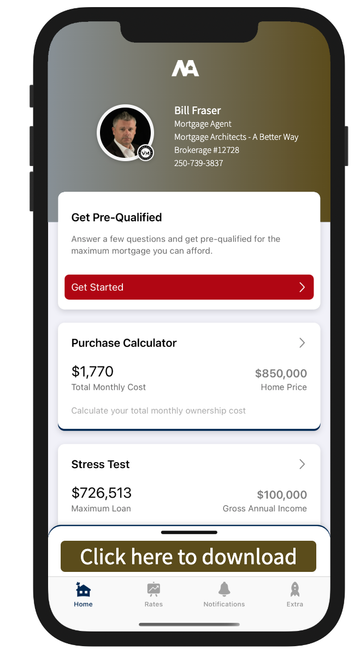

Download My Mortgage Toolbox

Access the calculators in 3 easy steps

- Add your phone number below

- Download the app

- Create an account

WHAT CAN YOU DO WITH MY APP

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

I'M A CERTIFIED REVERSE MORTGAGE SPECIALIST

Let's see if a reverse mortgage is right for you.

LEARN MORE

Testimonials

Shannon and Ashley Hughes

Sam and Nick

Thank You Bill.

Jamie and Vaughn

Thanks again.

Shirley McMillan

Bill, just wanted to send you a quick note of appreciation for your dedication to get me into my very first home! I did not think with my income and the little credit I have, that you would be able to pull this deal off. I have heard you are considered the “Miracle Man” around the island and it sure seems to be true!!!! Lol

Thanks so much, and I am proud to refer you to my family and friends all over BC!!!

Juanita LeMarquand

Mortgage Blog

Contact Me

+1 (250) 739-3837

Contact Us

Thank you for contacting me.

I will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.